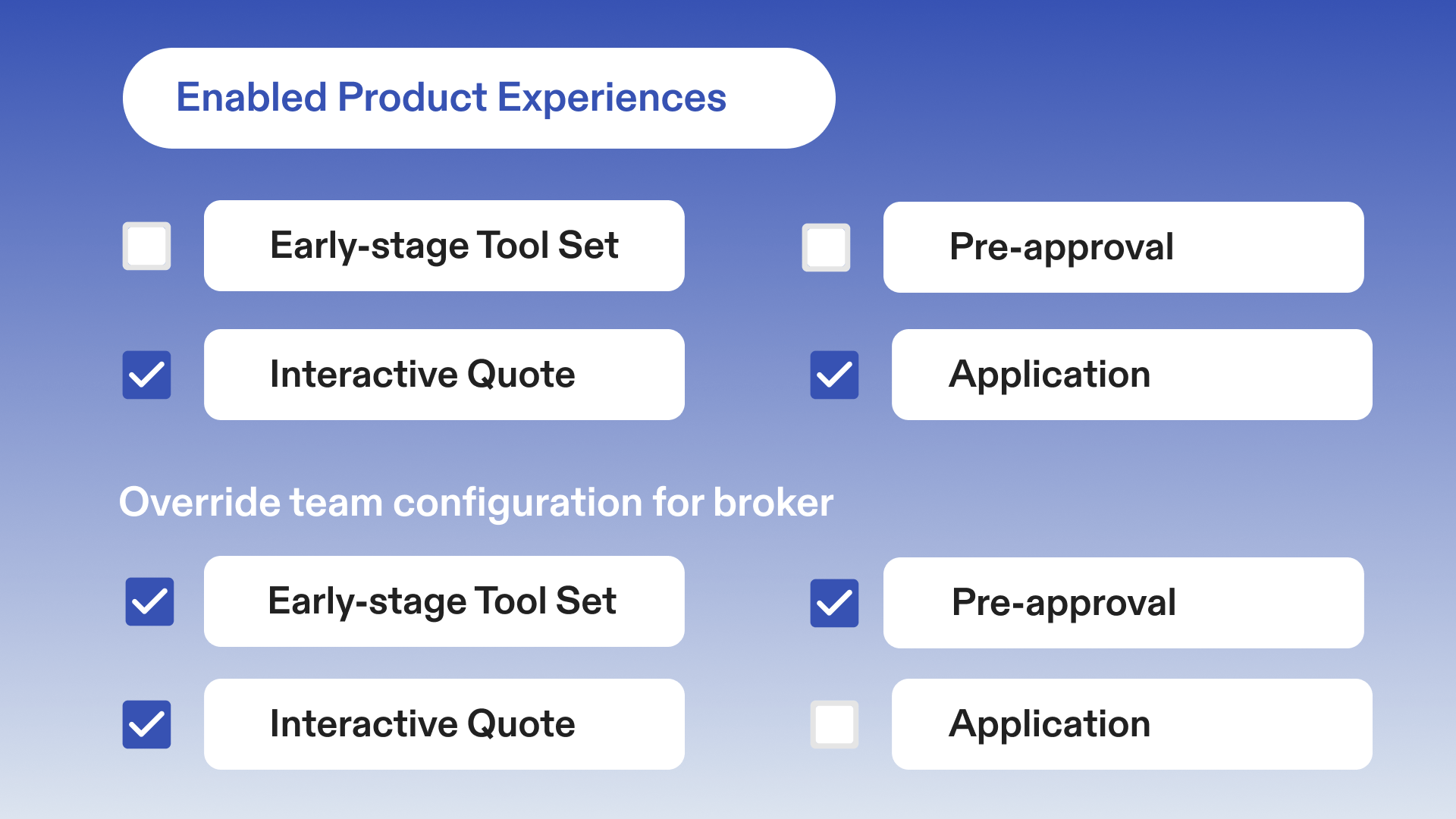

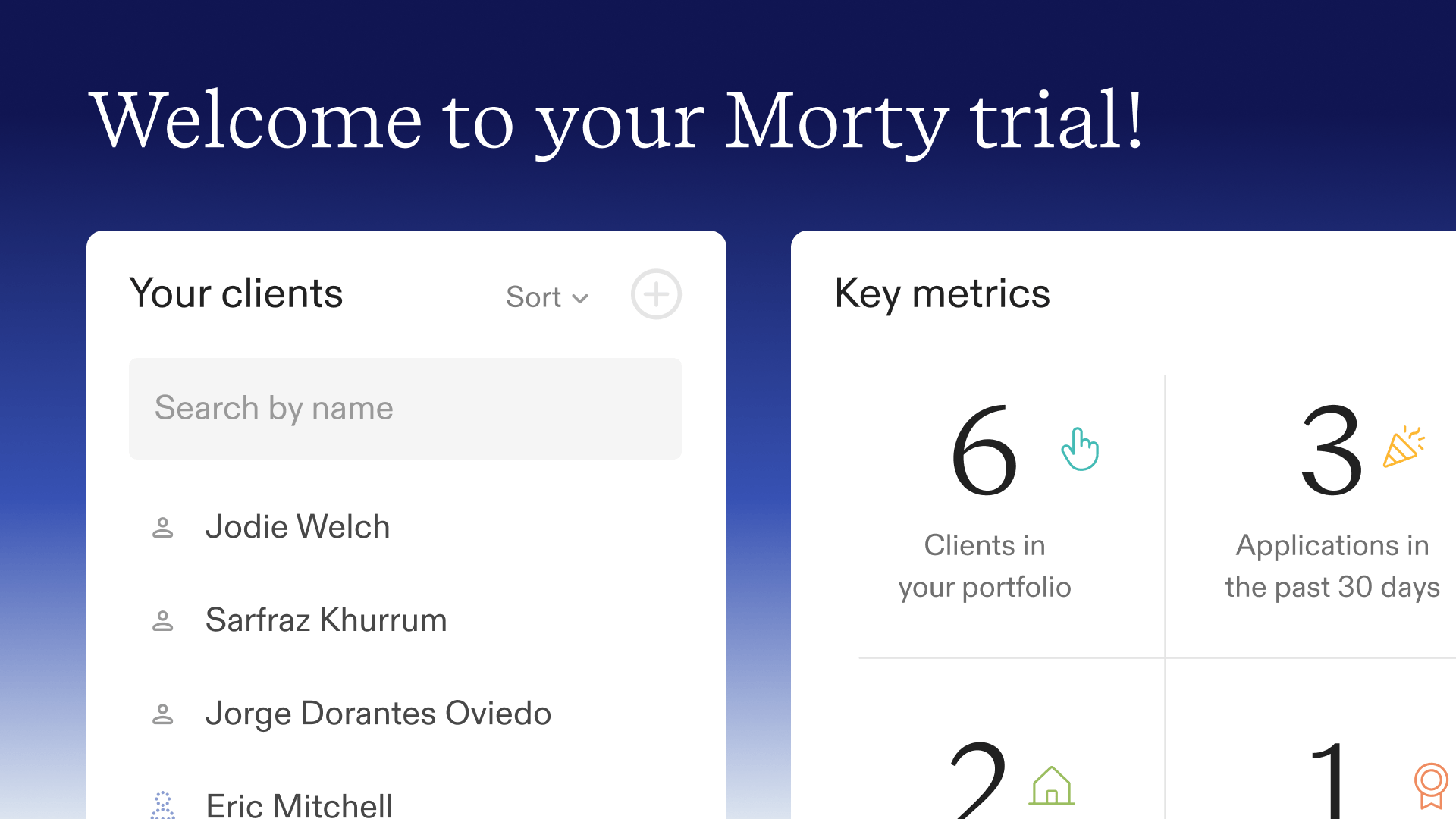

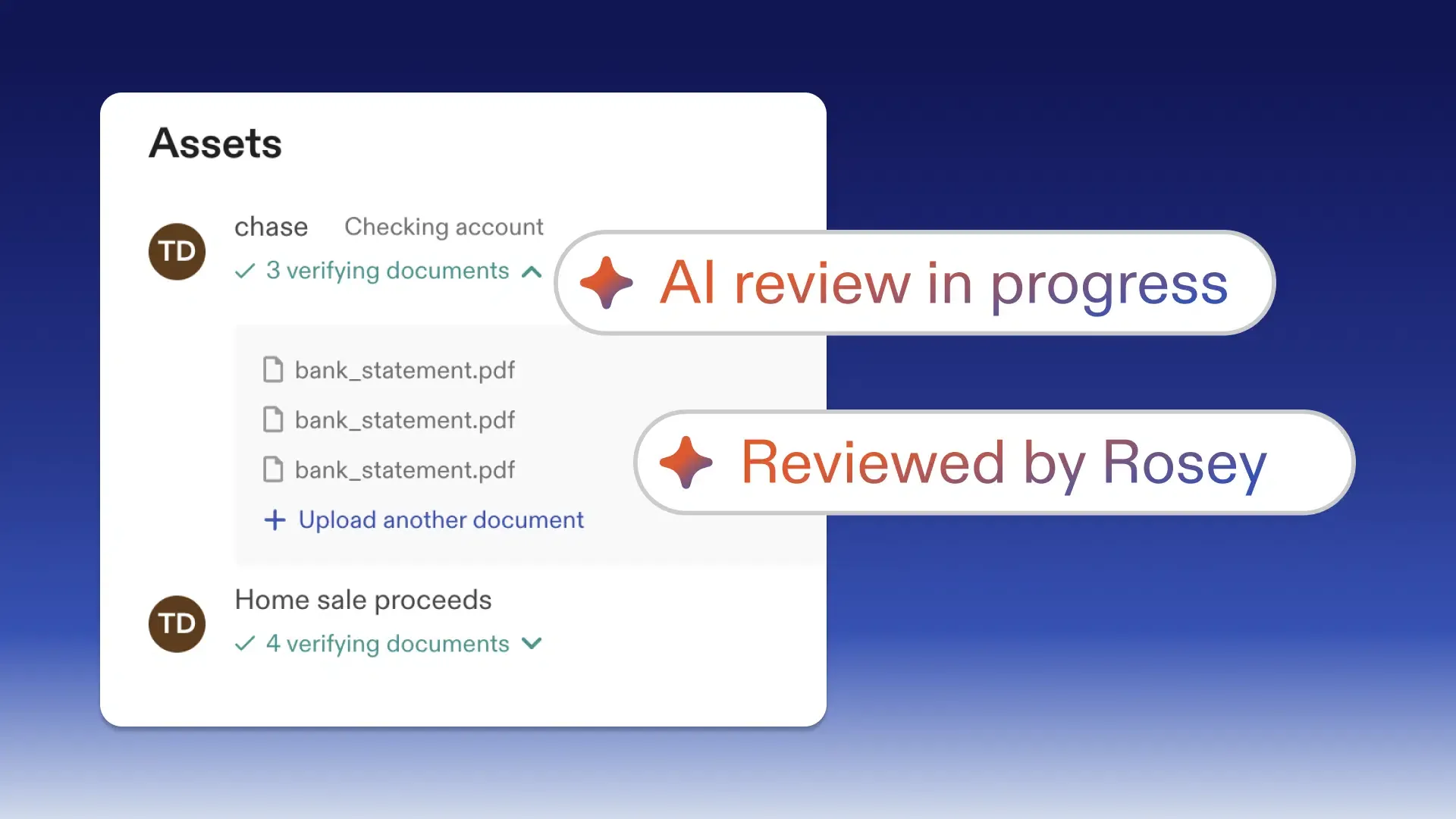

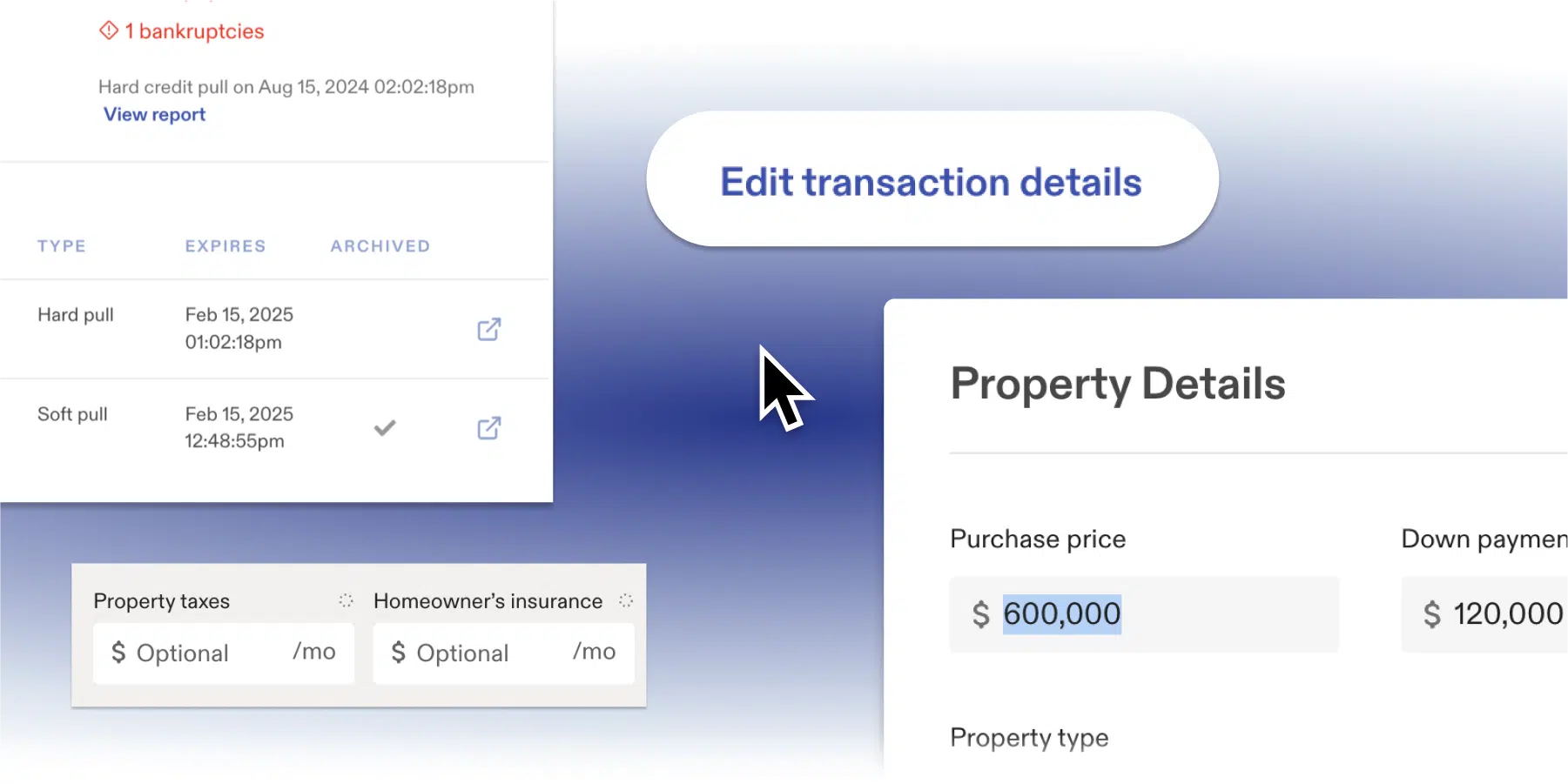

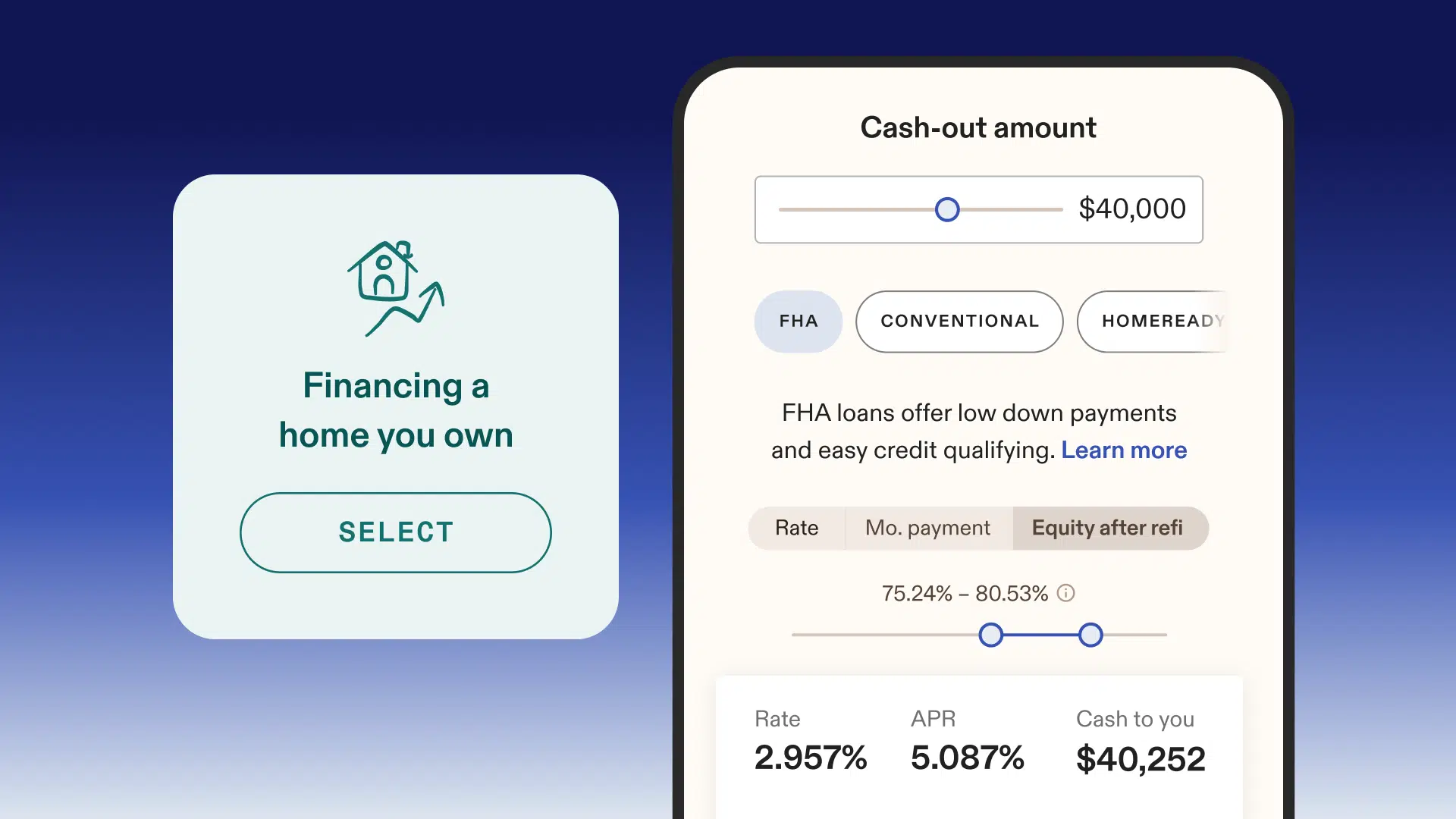

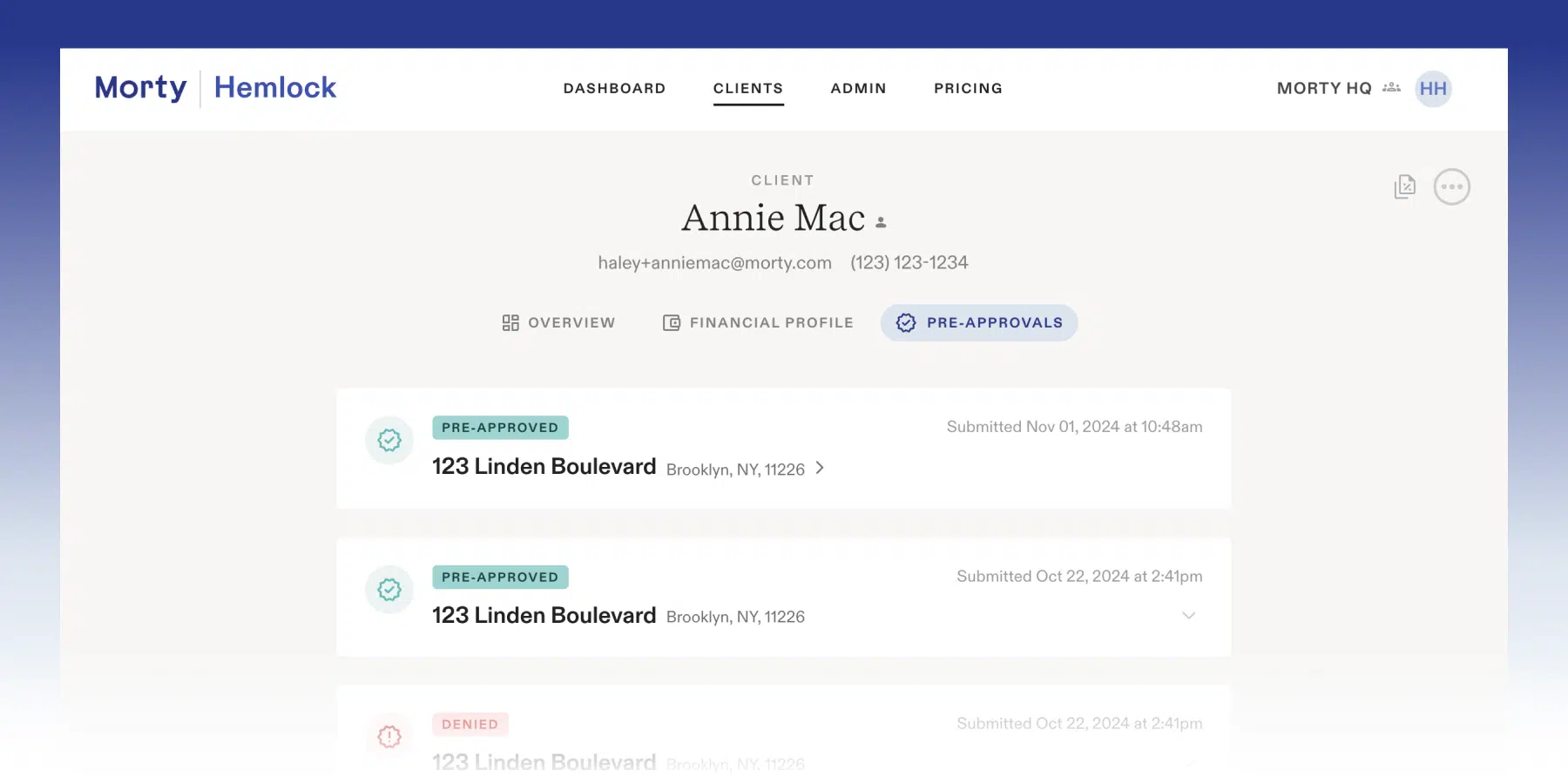

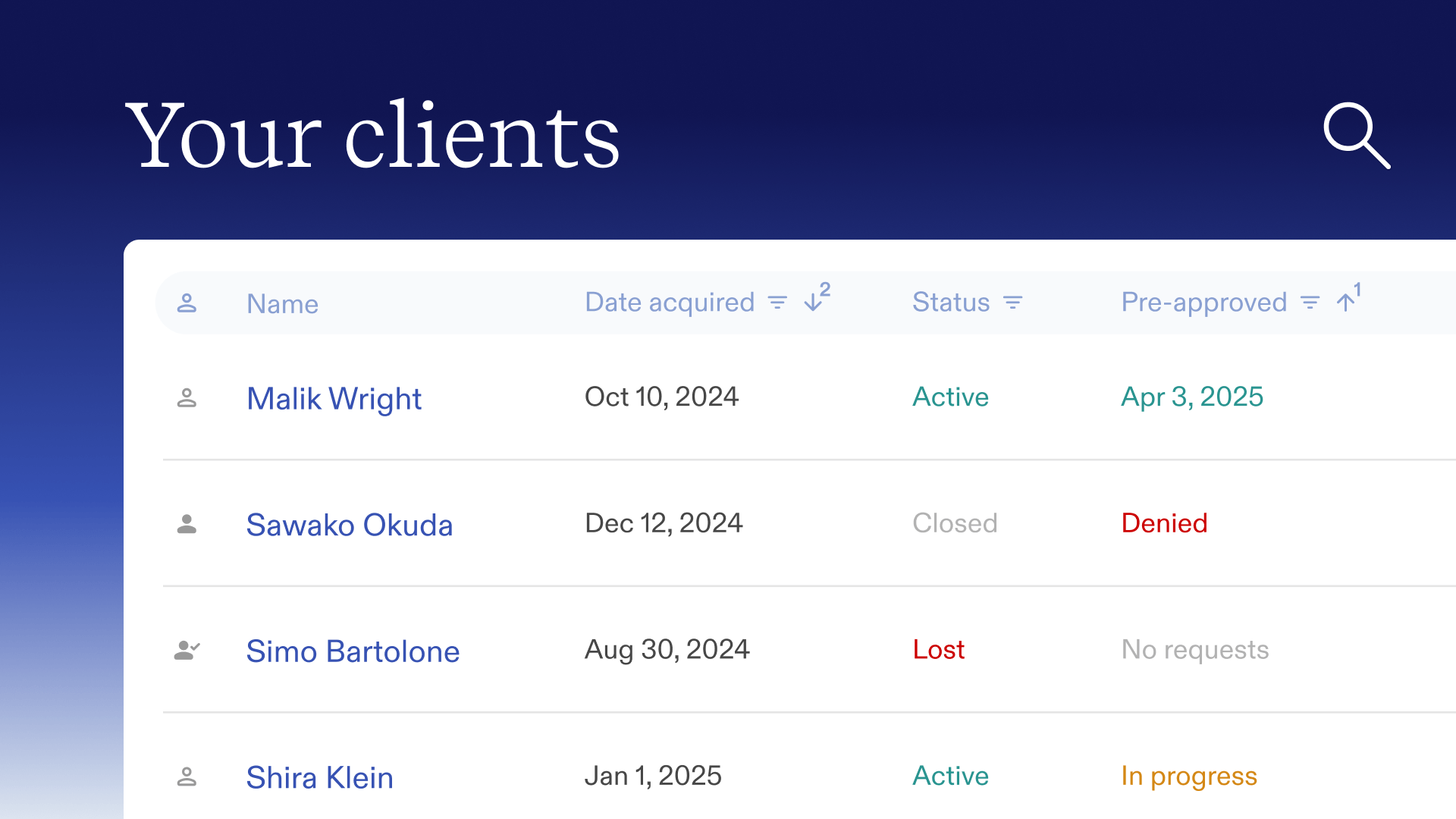

More control of client tools

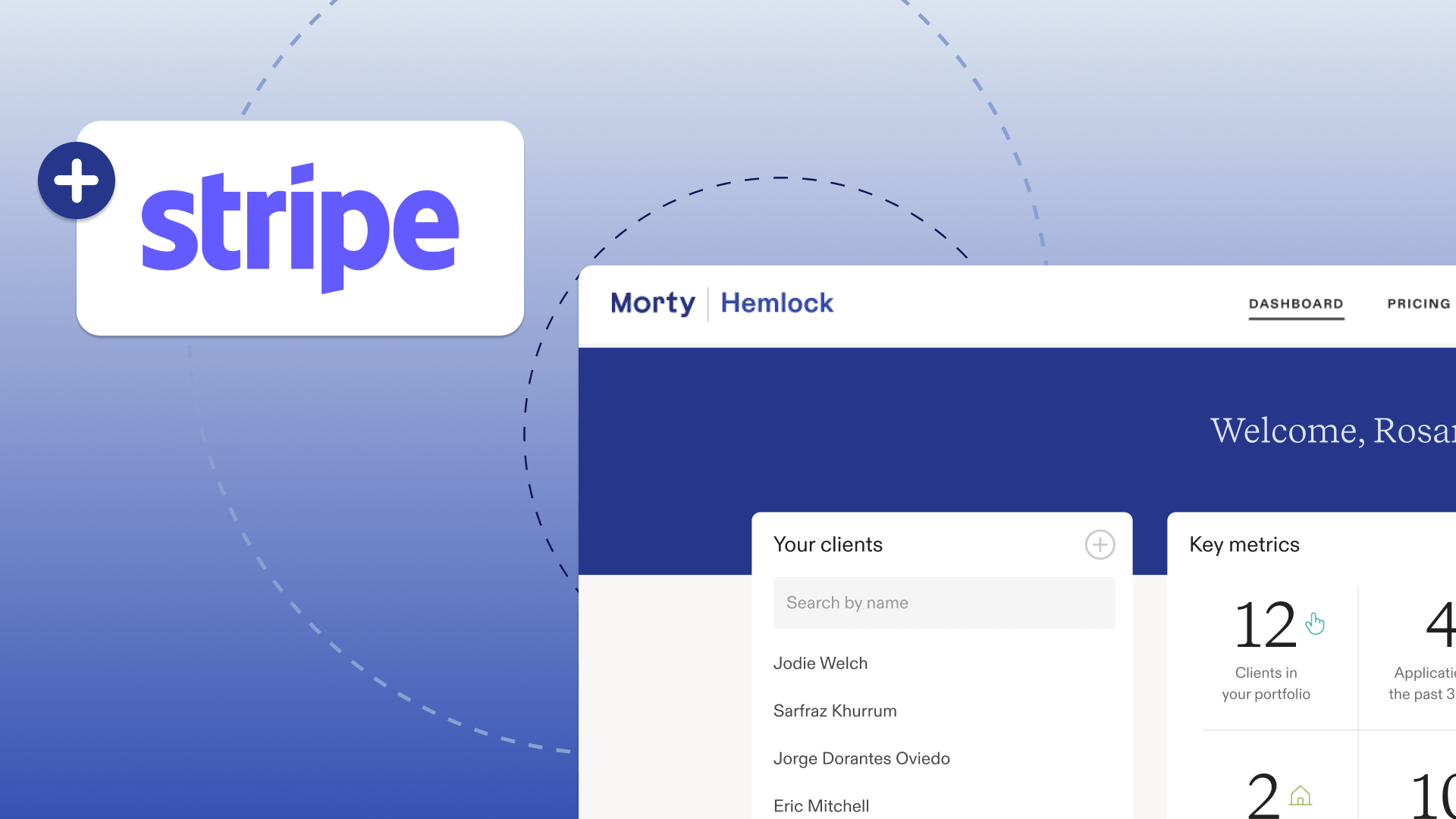

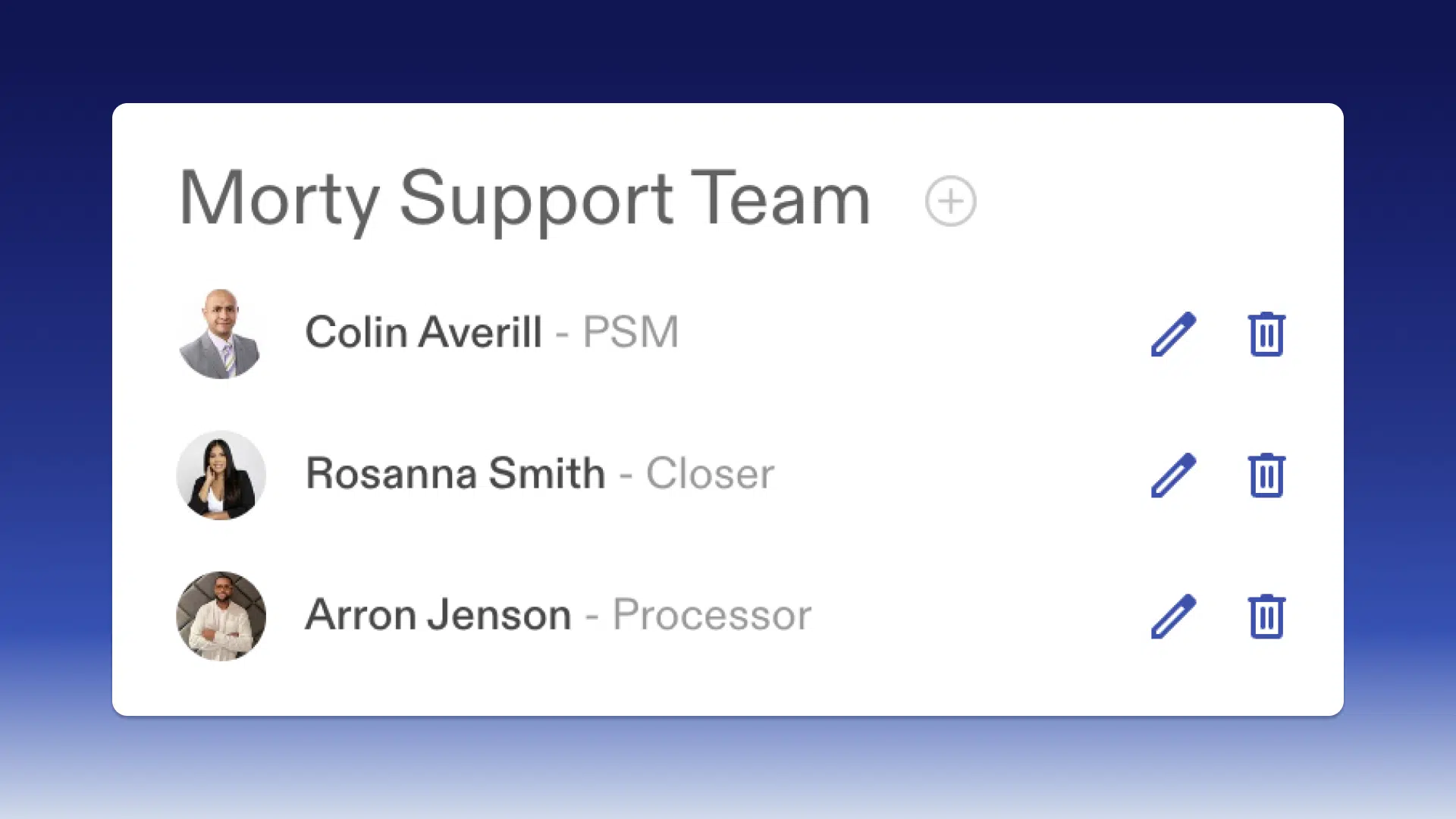

Take control of your client experience with new configuration options—tailor what tools borrowers see and how they move through your process.

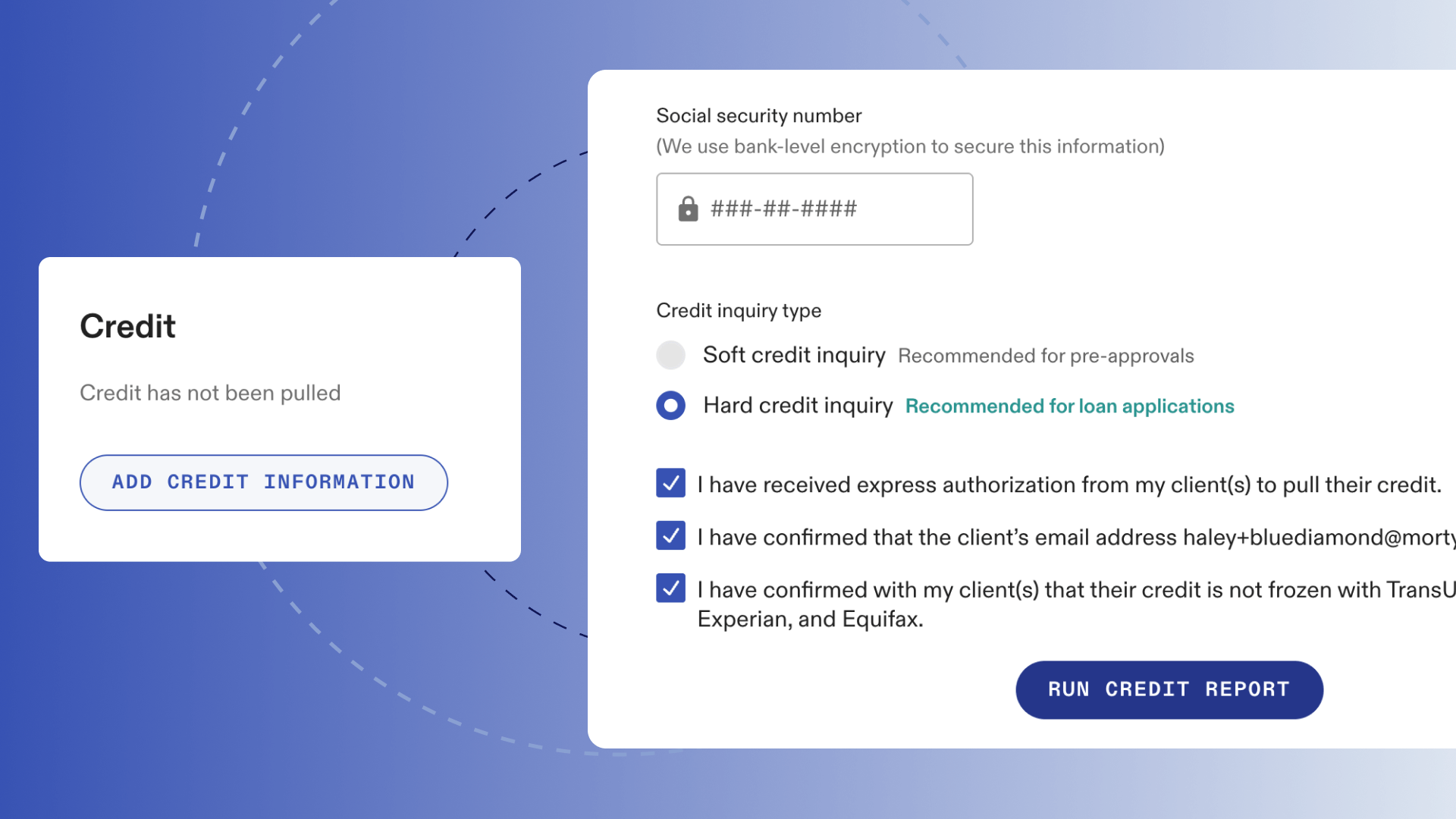

- Toggle borrower tools like rate shopping, application, and dashboard features

- Customize settings per loan officer or across your team

- Instant updates with no dev work required